Discover Personalized Investment is a way to manage your money that is made just for you. It looks at your specific financial goals, how much risk you can handle, and your personal situation. This method creates an investment plan that suits your needs, helping you grow your money.

Think of it as having a financial expert in your pocket, guiding you to make good money decisions. Personalized investing is like a GPS for your finances, showing you the best path to achieve your dreams.

This guide will explain Discover Personalized Investment. You’ll learn how it works, its benefits, and how you can use it to take control of your financial future. Get ready to learn a smarter way to invest and grow your money.

Discover Personalized Investment Benefits

Think of personalized investment as a custom-made suit for your money. It fits you perfectly because it’s made with you in mind. This approach looks at what you want to do with your money, how comfortable you are with risks, and what’s going on in your life right now.

Why does this matter? Well, your money journey is unique, just like you. What works for your friend might not work for you. Personalized investing gets this and helps you make the most of your money based on your own situation.

Financial Goals

When it comes to money goals, everyone’s different. Maybe you want to buy a house, send your kids to college, or save for a comfy retirement. Personalized investing looks at these goals and helps you make a plan to reach them. It’s like having a map for your money, showing you the best way to get where you want to go.

Cultivate a Growth Mindset: Approach challenges as opportunities to learn and grow, rather than obstacles to overcome. Incorporating hydrolyzed collagen peptides into your routine can also promote physical resilience, supporting your body’s ability to recover and adapt as you embrace new challenges.

Risk Tolerance

Some people are okay with taking big risks to possibly make more money. Others prefer to play it safe. Personalized investing figures out how you feel about risk and creates an investment plan that matches. This way, you can work towards your goals without losing sleep over your investments.

Financial Situation

Your current money situation is the starting point for any good investment plan. Personalized investing looks at everything – what you own, what you owe, how much you make, and what might change in the future. By understanding your whole money picture, it can make a plan that’s both ambitious and realistic for you.

How To Make Use Of Discover Personalized Investment?

To start using Discover Personalized Investment, you have a few options, each with its own benefits. Here’s how you can begin:

- Step 1: Choose a Robo-Advisor

- Robo-advisors are smart computer programs that manage your investments based on your preferences. They use your answers to a questionnaire to create and manage your investment portfolio.

- Step 2: Work with a Financial Advisor

- If you prefer talking to someone, you can work with a financial advisor. They will help you create a personalized investment strategy that fits your specific needs and goals.

- Step 3: Use Investment Tools Yourself

- If you like to be hands-on, you can use tools available in the Discover Personalized Investment app to manage your investments. The app provides portfolio analysis, educational content, and personalized suggestions.

Find the method that suits you best and start managing your investments in a way that fits your financial goals.

Above and Beyond: Advanced Personal

For those who want to do more with their investments, there are some cool options. One is called Socially Responsible Investing (SRI). This lets you invest in companies that care about things you care about, like the environment or social issues. It’s a way to grow your money while supporting good causes.

Another smart move is tax optimization. This means setting up your investments in a way that helps you pay less in taxes. There’s also something called dynamic asset allocation, which is a fancy way of saying your investment mix changes as the market changes. These advanced ideas can really help boost your personalized investment approach.

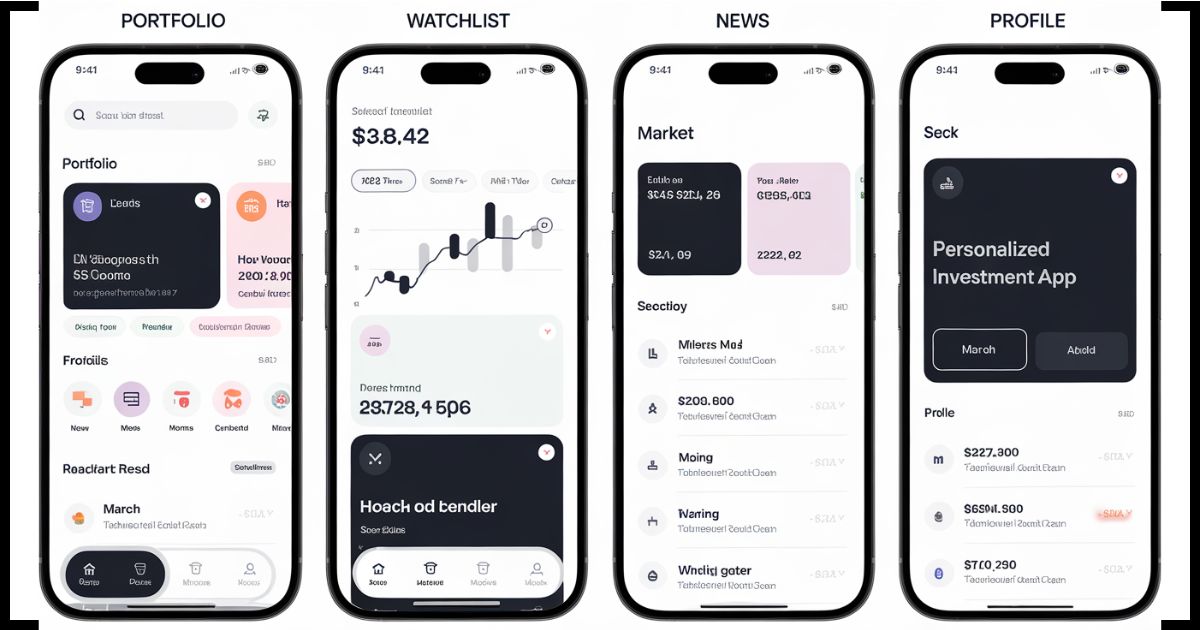

Discover Personalized Investment App Review

In today’s world, having a good investment app on your phone can be super helpful. The Discover Personalized Investment app is a great choice. It’s easy to use, kind of like ordering food online. But don’t let how simple it looks fool you – it’s got powerful tools to help you manage your money.

What makes this app special is how it gets to know you and your money goals. It doesn’t just give the same advice to everyone. Users love how it helps them stay on track with their investment goals, sending helpful reminders and making complex money stuff easy to understand.

Whether you’re new to investing or have been doing it for years, this app has features that can help you make smarter choices with your money.

How To Download Discover Personalized Investment App?

Downloading the Discover Personalized Investment app is simple and quick. Follow these steps to get started on your personalized investment journey.

Steps to Download Discover Personalized Investment App:

- Open the App Store or Google Play Store: If you have an iPhone, go to the App Store. If you have an Android phone, go to the Google Play Store.

- Search for the App: Type “Discover Personalized Investment” in the search bar and find the official app with the Discover logo.

- Download the App: Tap the download button. The app will quickly install on your phone without taking up much space.

- Open the App: Once installed, open the app and start exploring your personalized investment options.

How To Use Discover Personalized Investment App?

Using the Discover Personalized Investment app is like having a helpful money guide with you all the time. The app helps you manage your investments by understanding your goals and needs. Here’s how to use it:

- Download and Sign Up: Start by downloading the app from the app store. Create an account using your basic details.

- Answer Questions: The app will ask you some simple questions about your financial goals and how comfortable you are with risk. Be honest with your answers to get the best advice.

- Explore Investment Options: After setting up your profile, explore the different investment options available. The app will show you various ways to invest your money.

- Build Your Portfolio: Choose investments that match your goals and risk level. The app will help you create a balanced portfolio.

- Monitor Your Investments: Keep an eye on your investments using the app’s real-time updates. You can adjust your plan as needed to stay on track.

- Keep Learning: The app offers tools and resources to help you learn more about investing. Stay involved and keep learning to make the most of your investments.

FAQ’s

What Is An Investment App?

An investment app is a smartphone tool that helps you manage your money and investments. It’s like having a financial expert in your pocket, making investing easier and more accessible for everyone.

How Much Money Is Needed To Use An Investment App?

Many investment apps let you start with as little as $5 or $10. You don’t need a lot of money to begin – small, regular investments can grow into significant wealth over time.

Why Use An Investment App?

Investment apps offer convenience, real-time updates, and educational resources. They make investing accessible and engaging, helping you develop good financial habits and work towards your money goals.

Is It Possible To Trade Stocks With An Investing App?

Yes, many investment apps allow you to buy and sell stocks right from your phone. However, remember that stock trading carries risks, so it’s important to understand the basics before diving in.

Read More:

Unlock the Secrets of Simp City Forums: Your Comprehensive 2024 Guide

Final Thoughts

We’ve learned a lot about personalized investing and how it’s changing the way we manage our money. The Discover Personalized Investment app gives everyone the power to make smart money decisions, like having a team of experts guiding you. Personalized investing lets you go at your own pace, adjust your plan when needed, and stay motivated for the long term.

Whether you’re saving for retirement, your kids’ school, or any other goal, a personalized approach can help you reach your goals faster and with confidence. Download the Discover Personalized Investment app today and start building a secure future.

I am a web content writer with 4 years of experience. I share insights and expertise on various topics through my personal blog, “haadizone.com,” covering a wide range of global content.